eMarketer reports that the world wide transaction value of mobile payments will be close to $1 trillion in 2014. That's 6x the current value of $162 billion. This forecast from Yankee Group includes transactions from mobile banking, international and domestic remittances, contactless cards, mobile coupons, and near field communications (swiping your smartphone near a payment terminal). IT World reports that IE Market Research predicts the value will be even higher at $1.1 trillion and they believe that 1/3 of that forecasted value will be made up of the NFC transactions. The GSM Association has over 750 carriers around the world and they are working on standardized mobile payment systems to make these forecasts a reality.

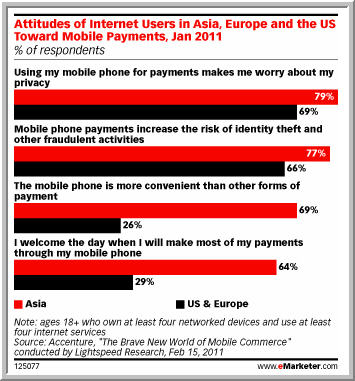

The idea of mobile payments hasn't caught on in the US just yet. Less than 10% of the those of us in the US have paid with our phones and only 29% of US and European respondents "welcome the day" when they can make payments using their phones, but IE Market Research shows that mobile payments are common in many other countries. For example, in Taiwan 32 % of users have made purchases via their phones. With Verizon, AT&T, and T-Mobile all hoping to roll out NFC services next year, mobile payments could become the norm in the US shortly.