Dreaming of retiring to that nice condo at the beach? Or maybe you'll use some of those golden years traveling the globe. Either way, it's time to start planning. Well, it was probably time to start planning as soon as you finished high school, but let's not dwell on that. Let's continue imagining ourselves at the beach and start being smart about how to get there. Here are a couple of tools we love for making sure you're on track with your retirement plans:

- While Social Security certainly isn't going to allow you to live in the lap of luxury, it's still a good idea to understand what your benefits will be. In the past, the Social Security Administration sent out statements showing your expected benefits. They no longer mail out statements, but now you can set up an account on their website to keep track of everything. Once you've created your account, you'll be able to see your estimated benefits based on retirement age. You can create your account here.

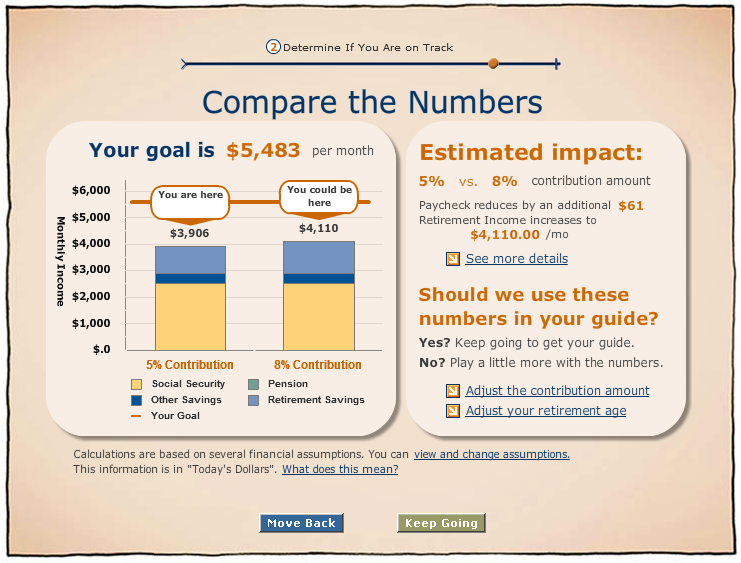

- Next you'll want to use a retirement calculator to see if you're on target. We like the one at Principal Financial Group because it's easy to use and at the end gives you a nice PDF showing where you stand and some "what ifs" to help you meet your goal. Their calculator allows you to include your 401K, IRAs, social security benefits and any other accounts you have to give a prediction for where you'll be based on when you want to retire. It's a good idea to run several scenarios for retiring at different ages. I ran 6 or 7 different ones showing outcomes for ages 60, 65 and 70 as well as a few different contribution amounts. You'll find their calculator here and below you'll see an example of a retirement goal with their suggestion to help reach your goal.

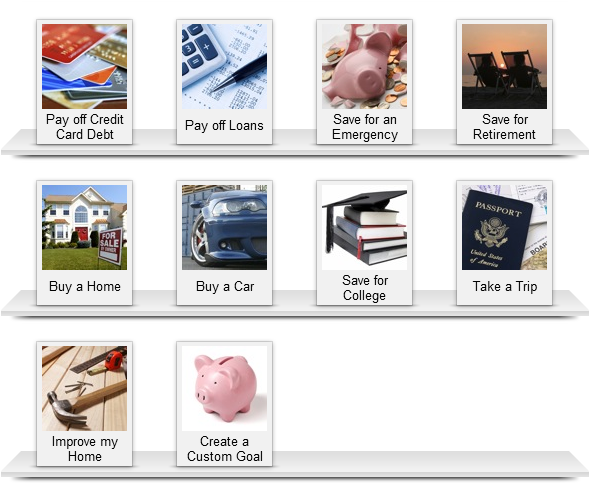

- We've talked about Mint before as part of our 50 Apps in 50 Minutes presentation. It's a great way to keep up with your finances and they've got a nice little tool for setting goals. You can set goals for things like vacations, paying down credit card debt and saving for retirement. The retirement goal lets you add in your 401K or IRA accounts and set a date so you can tell quickly if you're on track.