In today’s fast-moving business environment, having access to high-quality market research and competitive intelligence is essential. But not every company has the resources to build an in-house research team—or the need for full-time analysts. That’s where fractional research teams like Bizologie come in.

What is a Fractional Research Team?

A fractional research team provides businesses with on-demand access to expert researchers, offering the insights and intelligence they need—without the overhead of hiring a full-time staff. This model allows companies to scale their research efforts as needed, whether it’s for due diligence, market analysis, or competitive tracking.

Why Work with Bizologie as Your Fractional Research Team?

At Bizologie, we bring deep experience in competitive intelligence, market research, and due diligence, helping companies make informed decisions with confidence. Our team has worked with top firms in private equity, venture capital, consumer goods, manufacturing, finance, and more—delivering high-value insights without the need for an in-house research function.

How We Support Your Business:

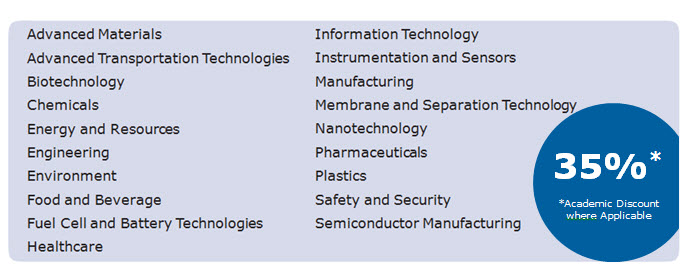

✅ Flexible Research Support – Tap into our expertise when you need it, whether it’s a one-off project or ongoing intelligence. ✅ Comprehensive Competitive Intelligence – We track competitors, industry shifts, and emerging trends to keep you ahead of the curve. ✅ M&A and Investment Due Diligence – We analyze acquisition targets, assessing everything from leadership and cultural fit to financials, patents, and market positioning. ✅ Industry-Agnostic Expertise – From consumer products to healthcare, logistics to financial services, we bring research experience across multiple sectors. ✅ AI + Human Analysis – We leverage AI for efficiency but ensure insights are vetted, contextualized, and tailored by expert analysts.

Who Benefits from a Fractional Research Team?

Private Equity & Venture Capital Firms – Need deep diligence on a deal but not a full-time research team? We provide the intelligence you need, when you need it.

Mid-Sized and Growing Companies – Get the strategic insights of a research department without the hiring commitment.

Corporate Strategy & M&A Teams – Whether you’re expanding into a new market or evaluating a competitor, our research provides clarity and direction.

Why Fractional Research is the Future

With the rise of data-driven decision-making, companies can no longer afford to rely on guesswork. At the same time, hiring and maintaining a full-time research team isn’t always practical. A fractional research team offers a cost-effective, flexible solution—giving companies access to top-tier intelligence without the long-term overhead.

At Bizologie, we know what to ask, where to look, and how to turn data into actionable insights. Let’s talk about how we can support your research needs—on your terms.